About My Bill

Resources to help you understand your bill.

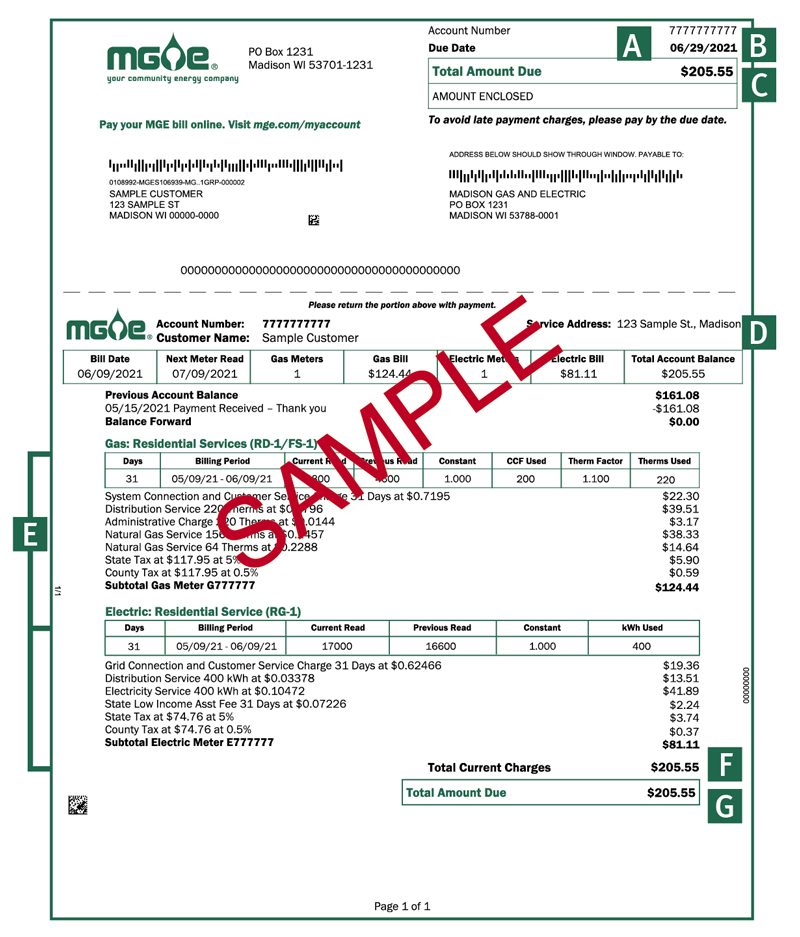

How to read your bill

A: Your 10-digit account number.

B: The date your payment is due to MGE.

C: The amount you owe by the due date; accounts on AutoPay will state "AutoPay Payment Scheduled, No Action Required."

D: The location where MGE provides service for your account.

E: Charges for the current billing period, broken out by natural gas and electric service.

F: Total charges for the current billing period.

G: The amount you owe by the due date. This includes charges for the current billing period and any past-due balance.

H: Learn about certain common charges/fees you may see on your bill.

I: Options for how to contact MGE to report an emergency, make a payment or ask questions.

Included with the Bill

February 2025

2025 Residential and Business Services and Prices

January 2025

Natural Gas Scratch & Sniff*

Save Time with My Account - Commercial

Save Time with My Account - Residential

*If you're signed up for Paperless Billing and would like to receive a Scratch and Sniff insert, please call MGE at 608-252-7222.

Personal Identification Number

MGE uses a four-digit personal identification number (PIN) to verify the identity of customers who contact us about their accounts. Customers receive their PIN through a letter by U.S. mail after they start service with MGE. The same PIN is assigned to multiple accounts under one customer name.

If you forget your PIN, call MGE Customer Services at 608-252-7222. We are not able to tell you your PIN. We will ask a series of questions to confirm your identity before issuing you a new PIN.

Utility Bills and Sales Tax

If you have questions regarding sales tax exemptions, please contact your tax advisor, visit Wisconsin Department of Revenue or call 608-266-2776.

- MGE residential customers do not pay state sales tax on their natural gas or electric service from November through April.

- Nonprofit, charitable and religious organizations are tax-exempt year-round.

- Commercial customers generally pay sales tax on their utility bills year-round, with some exceptions. Natural gas and electricity used in manufacturing are sales tax-exempt.

Tax-exempt

Most sales tax exemptions require the completion and submission to MGE of a Wisconsin Sales and Use Tax Exemption Certificate (Form S-211) or a Certificate of Exempt Status (CES) number.

Sales tax refund

If you discover that you or your business qualifies for an exemption but you have been paying sales tax, you may apply for a refund from the Wisconsin Department of Revenue. If you don't know how much sales tax you've paid for utility service, please email customerservices@mge.com for assistance.

Forms and information

For information and instructions about how to claim a Wisconsin sales tax refund, visit Wisconsin Department of Revenue or call 608-266-2776.

- Form S-220 BCR: Buyer's Claim For Refund of Wisconsin State, County and Stadium Taxes

- Form S-220a Schedule P: Attachment to Buyer's Claim For Refund of Wisconsin State, County and Stadium Taxes

If you complete Sections 1 and 3 of Form S-220a and send it to Madison Gas and Electric, Attention: Customer Billing, PO Box 1231, Madison, WI 53701-1231, we will complete Section 2 and return it to you so you can claim your refund.

If you can pay your utility charges incurred between October 31 and April 16 but don't pay within 80 days of when they are due, we may file court action against you. The annual utility shutoff moratorium ends April 15.

A court could award MGE payment up to three times the amount you owe (see Section 196.642 of the Wisconsin Statutes).