Governance

Board governance

Our board is led by our Chairman, President and CEO. With primary responsibility for managing the company’s day-to-day operations and for executing on the company’s vision and strategy, our CEO is best positioned to chair regular board meetings. This structure provides independent oversight while avoiding unnecessary confusion regarding the board’s responsibilities related to key business and strategic matters and day-to-day management of business operations.

Our Lead Independent Director has extensive authority and responsibility in ensuring the board meets its responsibilities for effective oversight and sound governance. The Lead Independent Director is responsible for the following:

- Board Leadership: Is empowered to call meetings of the board or executive sessions. The Lead Independent Director also is empowered to chair executive sessions of the directors.

- Board Information: Provides input to the Chairman on the scope, quality, quantity and timeliness of the information provided to the board and serves as a nonexclusive conduit to the Chairman of views and concerns of our directors.

- Corporate Governance Committee Leadership: Chairs our Corporate Governance Committee, which evaluates on an ongoing basis the composition, structure and performance of our board and assists in board recruitment, refreshment and succession planning.

Our board has four standing committees. All members of the Corporate Governance Committee, Audit Committee, and Human Resources and Compensation Committee are considered independent. The Executive Committee acts in lieu of the full board and between meetings of the board. The Executive Committee has the powers of the board in the management of the business and affairs, except action with respect to dividends to shareholders, election of principal officers or the filling of vacancies on the board or committees created by the board. Since our board meets 10 times a year, there has not been a need for the Executive Committee to meet or take action.

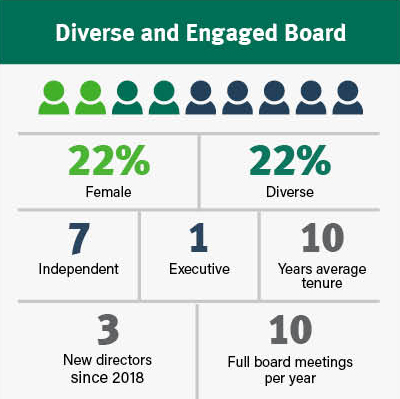

Our board is very active and engaged with 10 regularly scheduled meetings of the full board each year, in addition to committee meetings. Regular board meetings help directors stay well-informed of industry and company developments. Directors may not serve on more than three other public company boards.

MGE Energy board meetings are structured to provide for active dialogue with MGE management. Internal and external subject matter experts present to the board on issues of strategic importance to inform board members’ decision-making and oversight.

Some of the topics reviewed and discussed by the board in the last year included, but were not limited to, the following:

- Cyber and physical security.

- MGE’s carbon reduction goals and related initiatives.

- Emissions associated with the company’s purchase and distribution of natural gas and MGE’s natural gas emissions framework.

- MGE’s annual Corporate Responsibility and Sustainability Report and other environmental, social and governance (ESG) reporting and disclosures.

- Current and emerging environmental risks and risk mitigation.

- Generation facility retirement planning and potential capacity and energy replacement.

- Energy affordability and rates.

- State and federal legislation and regulatory policy.

- MGE’s top-ranked electric reliability.

- Company initiatives and investments.

The board’s interactions with internal and external subject matter experts provide useful information and insight relative to critical business initiatives and corporate strategy. These interactions inform the board’s understanding of the company’s financial performance, environmental performance, risk management and oversight, and succession planning.

Board members also have direct access to a network of resources and ongoing educational opportunities that support their ability to provide effective oversight and governance on a broad range of critical issues. This direct access includes director training and resources from:

- The National Association of Corporate Directors, an organization dedicated to advancing broad-based director education, including on governance and emerging issues;

- PricewaterhouseCoopers (PwC), which offers events and resources for directors to stay current on ESG-related topics, risk and other board responsibilities; and

- The Edison Electric Institute (EEI) and the American Gas Association (AGA), which also offer ESG-related topics specific to the energy industry.

Climate change and environmental expertise

The board has engaged and plans to continue to engage widely recognized scientific experts on topics related to climate change. Daniel J. Vimont, who serves as Professor, Atmospheric and Oceanic Sciences at the UW-Madison; Director, Nelson Institute Center for Climatic Research and Co-Director, Wisconsin Initiative on Climate Change Impacts, has presented to the board on climate change science, scenarios and projections.This is in addition to the board’s and company management’s regular engagement on emerging environmental risks and risk mitigation from internal subject matter experts. MGE management brings considerable environmental expertise as well as expertise in environmental law to the company.

In 2019, MGE management began working with experts from the UW-Madison’s Nelson Institute for Environmental Studies to evaluate the company’s net-zero carbon electricity by 2050 goal. The board has discussed the work of these experts to evaluate the company’s goal and strategies for achieving deep decarbonization by mid-century. See the Environmental section of this report for details of this independent analysis.

Board independence

The board makes an annual assessment of the independence of directors under the independence guidelines adopted by the Nasdaq Stock Market, Inc. The guidelines are generally aimed at determining whether a director has a relationship which, in the opinion of the MGE Energy board, would interfere with the exercise of independent judgment in carrying out director responsibilities. The guidelines identify certain relationships that are considered to affect independence, such as a current or past employment relationship with the company, the receipt by the director or one of his or her family members of compensation in excess of $120,000 from the company for other than board or board committee service and commercial relationships exceeding specified dollar thresholds. These guidelines also are reflected in MGE Energy’s Corporate Governance Guidelines.

The board has determined that seven of the nine directors are independent under the Nasdaq Stock Market, Inc., definition of independence and the company’s Directors Independence Standards, which parallel the Nasdaq Stock Market, Inc., definition. All members of the Corporate Governance Committee, Audit Committee, and Human Resources and Compensation Committee are considered independent. More information about the board is available in the company’s annual Proxy Statement.

Board assessment

The board conducts an annual board self-assessment, which includes an extensive survey covering board structure and composition, meetings, committees, key responsibilities and board management. In addition, the board periodically evaluates directors’ expertise and experience.

A peer evaluation occurs once every three years before nominating slates of directors for election and as part of succession planning to consider and to select new directors. This evaluation covers key professional skills, diversity, and breadth of community and other business experience and knowledge. In 2021, as part of ongoing board refreshment, the board welcomed a new director—its third new director since 2018.

In addition, each director conducts an individual self-assessment once every three years to evaluate their skills and experience relative to their board service.

Diverse experience and perspectives

Effective oversight comes from a board that represents a diverse range of experience and perspectives that provide the collective qualifications, attributes, skills and experience necessary for sound governance. The following reflects our board’s diverse range of experience and attributes.

- Financial Acumen (100%) – Experience as a principal financial officer, principal accounting officer, controller, public accountant or auditor. Experience in analyzing or evaluating financial statements, large capital projects, financings and/or budgets.

- Technology/Security (33%) – Experience in and understanding of the business and operations technical systems, including financial systems, grid operations and customer information systems. Understanding of the potential for physical and cyber threats to critical infrastructure and digital systems and the risk mitigation plans.

- Strategic Leadership/Governance (100%) – Experience as executive officer and/or senior leader in business or public service with an understanding of how to oversee complex organizations, provide effective corporate governance and enable a strong corporate culture.

- Legal/Regulated Industry (100%) – Experience working closely with government agencies and in a highly regulated business. Having worked in public policy for an organization that operates within the public policy and regulatory process.

- Customer/Community/Workforce (100%) – Understanding of and experience in working in the business and political environment of the company’s customer base. Understanding of customer service, experience and expectations, and of community matters, needs and interests. Community involvement through nonprofit, business and civic organizations. Experience in and understanding of employee relations and matters of diversity, equity and inclusion in the workplace and broader community.

- Environmental/Safety (56%) – Experience in and understanding of environmental policy and compliance, impacts and risks, and emerging issues and opportunities for greater sustainability. Experience in and understanding of workplace and/or public safety related to critical infrastructure and operations of essential services.

- Operations (56%) – Experience in the energy or utility industry or development, construction, manufacturing or essential services. Knowledge of electric generation and distribution or gas operations and distribution systems. Understanding of the technical issues and risks associated with the reliability, resiliency and safety of such systems.

Search by Governance area of interest

Oversight

Enterprise risk management

ESG reporting and stakeholder engagement